Mental illness & addiction are medical conditions & treatable

Overcoming Barriers

Public health crisis

Nearly one in five U.S. adults live with a mental health or addiction challenge,* and as many as one in six children between the ages of 6 and 17 has a treatable mental health disorder.

Despite its prevalence, millions of individuals and families face seemingly insurmountable barriers to getting appropriate and adequate behavioral health care. In fact, more than 50% of Americans who live with mental health or addiction challenges don’t receive treatment, or initial treatments are ineffective.

Imagine if one in two cancer patients went untreated. That is the reality for children, adolescents, and adults facing mental illness.

Fortunately, Rogers Foundation works closely with Rogers Behavioral Health to ease a constellation of barriers and gaps to treatment to ensure that those who are struggling with mental health or addiction challenges have access to the best care possible for as long as necessary to achieve full recovery.

*www.mhanational.org/research-reports/2022-state-mental-health-america-report

Understanding and overcoming the challenge

Social Stigma

Research shows that the most effective way to reduce stigma is to know someone with a lived experience of mental health challenges. See how you can help.

A study* on stigma concluded “there is no country, society, or culture where people with mental illness have the same societal value as people without mental illness.”

Nearly one-third of Americans have worried about others judging them when they told them they have sought mental health services, and over a fifth of the population have even lied to avoid telling people they were seeking these services.

- Will I be treated differently?

- Could I lose friends?

- Will it impact my job or livelihood?

Unfortunately, stigma, prejudice, and discrimination against people with mental health and addiction challenges remains a very real problem in our world.

Studies on stigma show that while people generally accept the medical or genetic nature of a mental health disorder and the need for treatment, many have a negative view of the individuals living with mental illness. And, stigma not only directly affects individuals with mental illness but also the loved ones who support them, especially family.

Rogers responds

People with mental health and addiction challenges who share their recovery experiences is the primary evidence-based practice to reduce stigma. To that end, Rogers’ works to reduce the stigma surrounding mental illness and addiction through community collaborations aimed at illuminating effective treatment and recovery practices. Evidence-based initiatives include:

- Oversight of Wise Initiative of Stigma Elimination (WISE)

- The power of story

- Compassion Resilience

- Safe Person and Seven Promises

- Strategies for recovery

- Up to Me

Rogers Foundation specifically supports one individual whose mission is to expand the Up to Me program in the community and online. In this series of classes, facilitated groups of teens or adults explore the move towards strength-based self-stories, pros and cons of disclosure, and a helpful process of decision-making about whether, to whom, and how to talk about one’s experiences.

Learn more at WISE.

Lack of Specialized Services

The need for high quality psychiatric care far exceeds the resources available. Rogers is taking steps to change that.

The statistics are staggering and getting worse. The lack of evidence-based behavioral health treatment programs has reached epidemic proportions across the country.

- Over 60% of youth with major depressive disorder do not receive any mental health treatment*, and only 27% of youth who are treated receive consistent care.

- Fewer than 10% of Americans with OCD** receive evidence-based treatment.

- In 2020, the rate of drug overdose deaths increased 31% from the year before***, exposing large gaps in access to specialized addiction treatment programs.

Rogers responds

For decades, individuals and families have left their hometowns to benefit from Rogers’ specialized mental health services. In fact, 40-50% of patients in treatment programs at Rogers in Oconomowoc, WI, come from out of state.

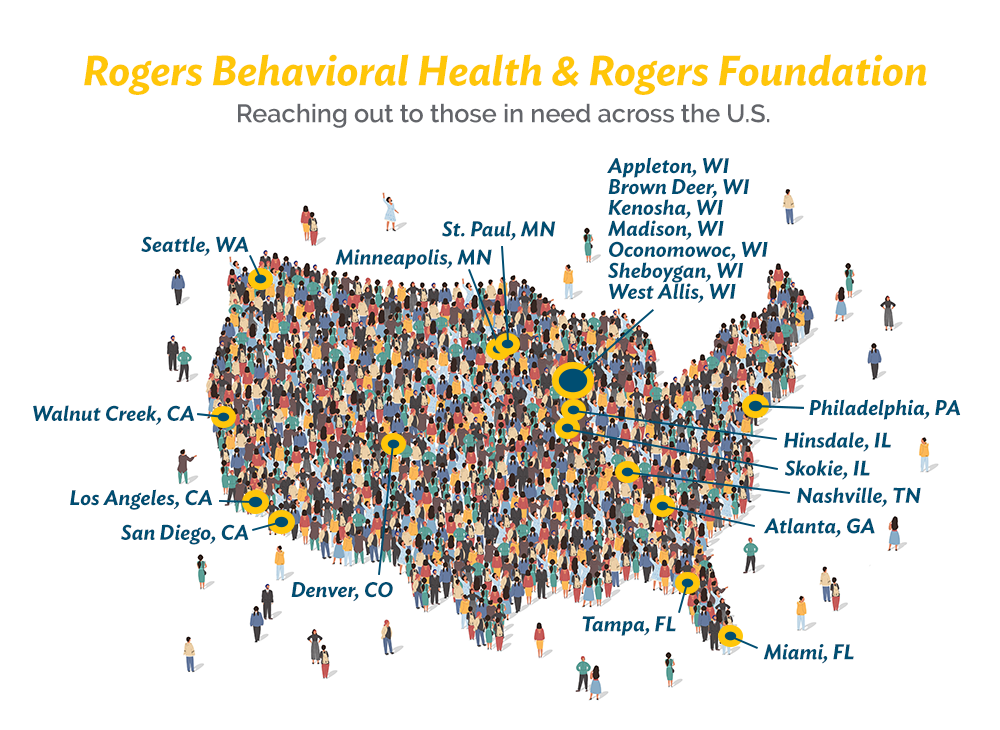

Rogers has made a commitment to alter this disparity of local specialized treatment programs. Within the past decade alone, Rogers has opened clinics in 10 states in order to meet the urgent and unfulfilled needs of communities from coast to coast. This is thanks, in part, to the financial support of grateful patient families who are determined to bring Rogers Behavioral Health’s specialty programs closer to their communities.

Insurance Barriers

Limited insurance coverage makes it difficult for patients to receive adequate treatment for long-term recovery. Rogers takes action.

Federal parity regulations were created to ensure that mental health and addiction treatment is covered the same as that for physical illness. However, loopholes exist that make it difficult for behavioral health patients to receive the level of care they need for recovery.

Narrowly defined networks make it hard for people to access mental healthcare, as people often face challenges identifying providers who will accept their insurance.

- It is not unusual that an insurance policy sets a lifetime limit of $1 million for medical care, but less than $50,000 for lifetime mental health and addiction treatment.

- Many insurance agencies only provide coverage to individuals who are suicidal, homicidal, or unable to function. At Rogers, these individuals are admitted for inpatient care. Once the patient is temporarily stabilized, coverage ends. The patient’s critical needs are met, but treatment to sustain a healthy and productive life falls short.

Rogers responds

Utilization review

To combat this issue, Rogers Behavioral Health created a Utilization Review Department. This department evaluates a patient’s medical needs at the time insurance denies coverage for treatment.

They determine when it is appropriate to go back to the insurance company to make the case for coverage. They have reported that the inpatient denial rate for coverage is 3%, partial hospitalization denial rate is 10% and residential denial rate is 25%. The department conducts 20,000 reviews each year.

Because of the rate of denial, Rogers has also hired financial counselors to work with families to help navigate the insurance process and to create payment plans when needed in order to ensure admission to, or completion of, the treatment process. Families know ahead of time that if or when insurance ends, a backup plan is already in place.

Patient Care Grants

Rogers Foundation provides Patient Care Grants to families who have reached their limit for insurance coverage, as well as for those whose personal resources are depleted. These grants give patients the opportunity to continue treatment to the point of full recovery.

During fiscal year 2021, the Foundation distributed $1.5 million in patient care grants, amounting to 2,150 days of treatment for those in need.

Financial Burdens

45 million Americans live below the poverty rate, and millions more lack the financial resources required to pay out-of-pocket for their mental health care needs. Rogers brings treatment to those in need.

Millions of American families are one emergency away from a financial crisis, as evidenced by a 2020 Federal Reserve report indicating that one in four households have little to no financial cushion to fall back on.

When facing mental illness or addiction, receiving proper treatment is essential. Yet, when people seek care, they often stumble into a cycle where financial burdens and mental health challenges feed into each other and prevent full recovery.

One in four (25%) Americans reported having to choose between getting mental health treatment and paying for daily necessities.

Rogers responds

Charitable care

Rogers Behavioral Health is committed to bringing quality treatment to as many people in need as possible. Toward this goal, the hospital provides charitable care to patients who lack adequate insurance and financial resources.

- Rogers Behavioral Health provides more than $6 million in charitable care each year

Angel fund

Clinical teams at all Rogers’ programs throughout the country may apply for the Foundation’s donor-supported Angel Fund when they perceive that an individual or family is struggling financially during treatment.

- Last year, more than 200 requests for Angel Funds were met ($150 ave.) to help pay expenses ranging from travel, to rent and sober living, and even an eye exam and glasses for an adolescent patient with vision issues.

Patient Care Grants

In additional to Rogers’ charitable care, Rogers Foundation provides Patient Care Grants to families who have reached their limit for insurance coverage, as well as for those whose personal resources are depleted. These grants give patients the opportunity to continue treatment to the point of full recovery.

Last year, the Foundation provided $1.5 million in grant funding, totaling roughly 2,150 days of care.

Watch more Rogers Foundation videos on our YouTube channel.